May asks for Brexit extension to 30 June as Tusk offers up to a year As the uncertainty of Brexit continues, the complex issues of derivative-clearing, termination and re-signing of various CDS contracts that have been cleared or routed through the City of London stays unresolved. Deriveum

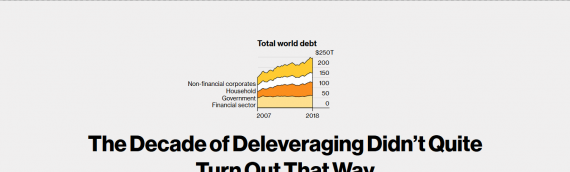

Read more →The Decade of Deleveraging Didn’t Quite Turn Out That Way Bloomberg has a very interesting interactive article that describes the increased leveraging of the global financial system. Even though in some cases banks and other financial institutions has their balance sheets slimmed down, especially as off-balance sheet

Read more →German economy will grow 0.7 percent this year if Brexit is disorderly: BDI The Federation of German Industry (BDI) expects a severe recession in the UK, should the latter leaves the EU without a deal. That would spill over to the rest of the continent also affecting

Read more →EU watchdog holds fire on derivatives action under no-deal Brexit Reuters reports that no-deal Brexit will cause disturbance among derivative users and CDS holders in particular, as it might necessitate contract premature termination and changes of conditions. Using Deriveum both sides of the contract would enjoy much

Read more →Global Sovereign Debt Visualized This visualization by HowMuch.net illustrates the considerable difference in indebtedness of various governments as percent of their GDP. The difference would illustrate a number of very profitable possibilities for Deriveum use as backing a number of sovereign’s bonds such as Lebanon, Congo, Egypt,

Read more →Wall Street Looks for Fix to Shady Credit Default Swap Market amid Windstream Bankruptcy Talk Business & Politics’ Wesley Brown reflects on the recent issue of engineered bankruptcies that puts additional strains on the CDS market. The use of Deriveum as a collateral offers much more flexible,

Read more →The Era of Cheap Money Shows No One Knows How Monetary Policy Works Ben Holland makes analysis on recent monetary policy trends. In short the low-rate environment has helped sovereign borrowers, rather than the real economy. In our view this article underlines the dangers for governments that

Read more →No-deal Brexit will hammer both UK and EU The Brexit no-deal scenario will hit hard the financial and real-economy alike. On a per capita basis, however, Britain and Ireland will probably be the biggest losers by far. UK income is expected to fall by €873 per head,

Read more →This is an article by Bloomberg concerning the CDS market Sometimes Credit Default Swaps Are Things of Beauty Why not make CDS buyers and sellers compete with each other to benefit the underlying company? You may read the entire article by clicking on the link below: https://www.bloomberg.com/opinion/articles/2018-12-13/credit-default-swaps-get-weird-after-sears-bankruptcy

Read more →